Change your thinking: Why prepping is a form of life and health insurance

10/11/2018 / By Tracey Watson

Most people would agree that responsible financial planning includes the need for various forms of insurance. While the needs of each family are unique, generally this insurance would include things like vehicle insurance, medical insurance, travel insurance, household insurance, life insurance and so on.

Though they provide coverage for different risks, basically all insurance boils down to one thing: The client pays an insurance company an annual lump sum or monthly amount to protect them against the risk of a certain thing happening (e.g. the risk that your house might burn down). If the insured event never takes place, the insurance company just gets to keep the premiums, but if disaster does strike, the company will pay the client out a predetermined amount of money to compensate them for their loss.

What many people don’t realize, however, is that there is another form of insurance that is just as important, if not more important: preparing for natural or other disasters by having an emergency plan, stockpiling food and medical supplies, and generally being ready for whatever life might throw at you. In other words, prepping.

After all, it’s true that financial compensation from an insurance company after a devastating event is important. However, the ability to cope and even thrive during that event is what prepping insurance is all about.

Why prepping is just as important as a comprehensive insurance portfolio

Some people think of preppers as conspiracy nuts who think the apocalypse is just around the corner, build bunkers under their houses, and are generally pretty unhinged. In reality, though, preppers are simply people who want to be prepared for any eventuality – from hunkering down at home during a hurricane, to having the necessary medical supplies on hand after an earthquake.

As noted by The Simple Prepper, preppers are organized people who ensure that they have all the knowledge, training, tools and supplies needed to deal with potentially difficult and dangerous situations. It’s just like buying insurance, but instead of paying a company money which they repay you when there’s a disaster, you are simply using your money to ensure you’re prepared for whatever the future may hold.

Where to start

The Simple Prepper notes that there are three basic things to consider when making the decision to start prepping:

1. What your current situation is (i.e. if you have a family, where you live, what your financial life is like, and what possessions you have).

2. What kinds of emergencies are most likely to affect you, such as a hurricane, snow storm, earthquake, or other.

3. What you would need to do to protect or prepare yourself, your family, and your possessions from these potential emergencies.

Once you understand what your assets are and what potential threats they face, you can start to consider what you might need to do to protect your assets (including family). Every Prepper – and every Prepper’s strategy – is different. Thus, it’s important to figure out what your unique needs are so you can formulate your own action plan.

Once you’ve evaluated the unique needs of your family, prepping will generally fall into one or more of the following three categories:

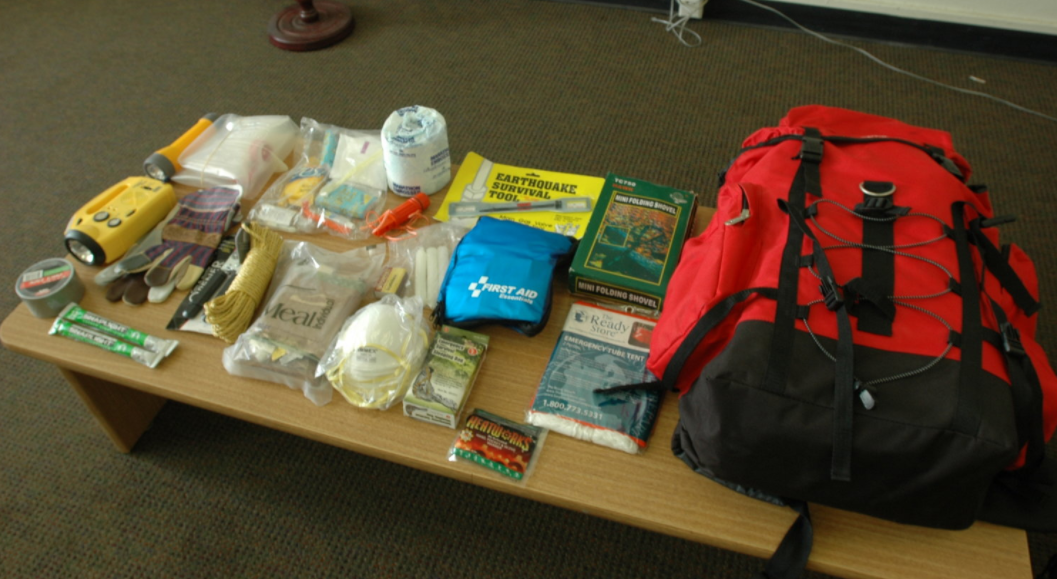

- A stockpile of emergency supplies kept at home;

- An everyday carry kit (EDC kit) for your vehicle; and

- A well-stocked bugout bag

Of course, even the most organized prepper cannot be 100 percent prepared for every single eventuality, but preparing ahead of time for the most likely disasters your family is likely to face means you have the best possible chance of staying reasonably safe and secure, come what may.

Learn more about prepping for every eventuality at Preparedness.news.

Sources for this article include:

Tagged Under: bugout bags, EDC kits, emergency supplies, everyday carry kits, insurance, off grid, preparedness, prepping, SHTF, stockpiling, survival